In a financing, the customer originally receives or borrows an amount of money, called the principal, from the loan provider, and is obligated to pay back or repay an equivalent amount of cash to the loan provider at a later time. Generally, the cash is repaid in routine installments, or partial repayments; in an annuity, each installation coincides quantity.

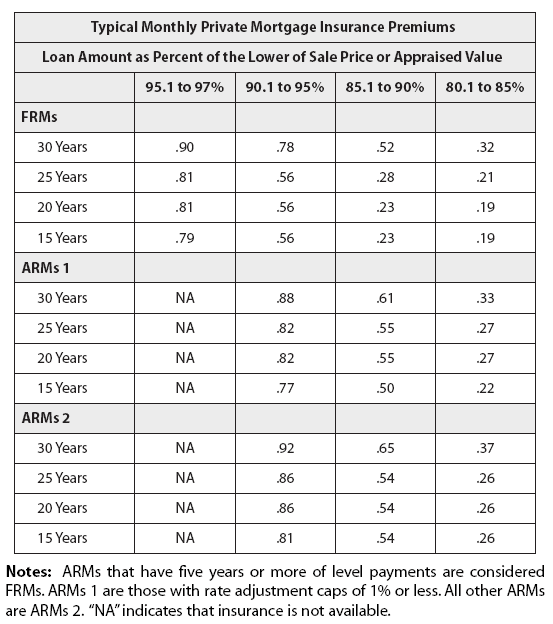

4 quick reactions to FHFA mortgage insurer liquidity planHousing Wire (blog)“Updating eligibility requirements for mortgage insurers is an important part of reducing risk to taxpayers and building a safer, stronger housing finance system for the future. The draft requirements seek to ensure that mortgage insurance companies ......4 quick reactions to FHFA mortgage insurer liquidity plan - Housing Wire (blog)

I wish you found the above information interesting. You can figure out much more in the write-ups below.

More Information